In a statement published on the website of Japan’s Ministry of Economy, Trade, and Industry, the Cabinet approved a bill on February 16 aimed at boosting national industrial competitiveness and taking a significant step toward openness in the digital asset space. The government, led by Prime Minister Fumio Kishida, introduced legislation that allows venture capital firms and other investment funds to hold digital assets directly and supports the growth of Web3 companies based on blockchain technology, a critical component of the future decentralized internet.

The passage of this bill will enable investment limited partnerships to include cryptocurrencies in their portfolio of assets to acquire and hold, reflecting Japan’s new open stance on digital asset regulation. Japan is not only at the forefront of creating a regulatory framework for stablecoins but also maintains a strong position on user protection while promoting the development of Web3. Once this legislative reform is enacted, it will significantly impact Japan’s Web3 venture capital scene and could set a precedent for other nations.

UPCX: A One-Stop Financial Ecosystem

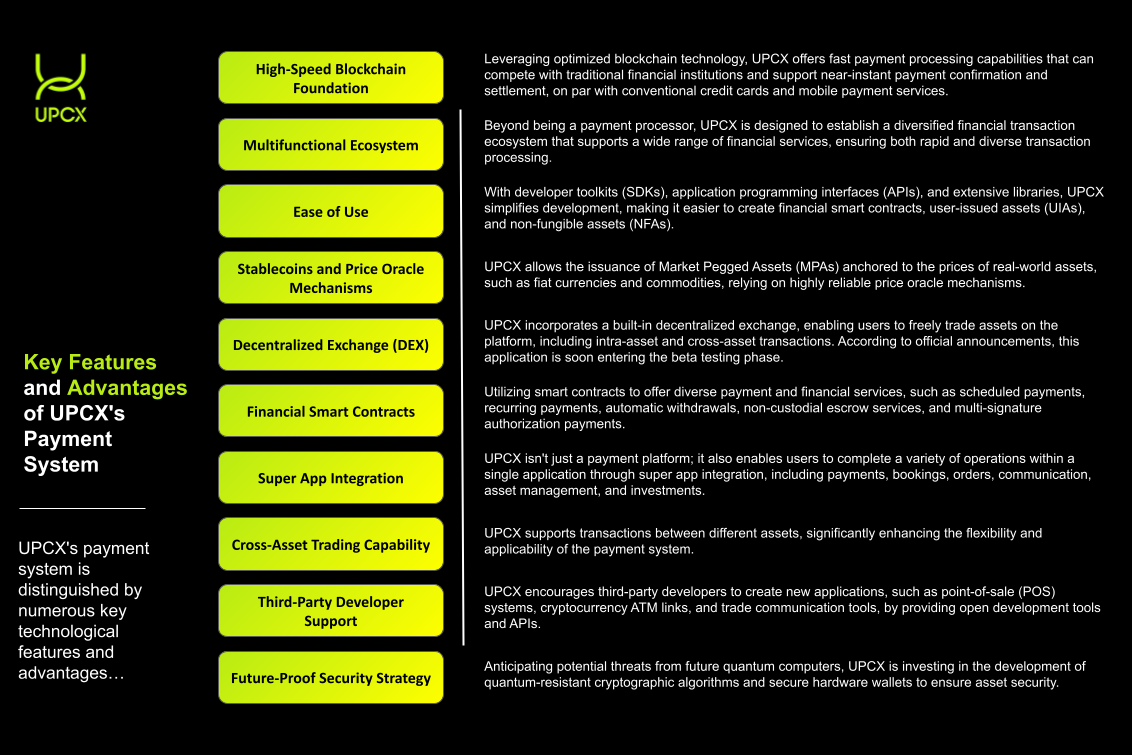

Against this backdrop, UPCX, a blockchain-based open-source payment platform, is demonstrating considerable potential for growth with its innovative technology and a suite of financial services. The platform, built on the principles of security, transparency, and compliance, offers rapid payment processing capabilities, a feature that is particularly evident in its efficient blockchain-based payment system. UPCX can deliver payment processing speeds that match or exceed those of traditional financial institutions, meeting modern consumers’ demand for instant payment confirmation and settlement.

UPCX is more than a payment processor; its multifunctionality extends to supporting a wide range of financial services, including smart contracts and asset management, creating a comprehensive one-stop financial ecosystem. Developers can use the platform’s SDKs and APIs to easily create and integrate financial smart contracts, user-issued assets (UIAs), and non-fungible assets (NFAs). Additionally, the inclusion of a decentralized exchange (DEX) and support for stablecoins and price oracle mechanisms further broaden the scope of trading possibilities, including intra-asset and cross-asset transactions, enhancing the platform’s versatility.

Smart contracts on UPCX expand the range of payment and financial services, including but not limited to scheduled payments, recurring payments, and multi-signature authorization payments. These services, integrated through super applications, allow users to complete various operations such as payments, bookings, orders, and asset management within a single application, significantly enhancing user experience.

For third-party developers, UPCX’s open platform and tools inspire the creation of new applications, such as point-of-sale (POS) systems and cryptocurrency ATM links, further extending UPCX’s use cases. Moreover, acknowledging the potential security threats from future quantum computers, UPCX is proactively developing quantum-resistant cryptographic algorithms and secure hardware wallets to ensure asset safety, showcasing its forward-thinking approach and preparedness for upcoming technological challenges.

UPCX’s Compliance Journey and Strategic Initiatives

UPCX’s commitment to global financial regulatory compliance has been recognized by the Financial Market Authority (FMA) of Liechtenstein, a validation not only of its compliance but also of its support for global expansion strategies. The collaboration with VNX demonstrates UPCX’s dedication to adhering to applicable laws and regulations, ensuring the legality of its operations and regulatory compliance while protecting investor assets and ensuring transaction transparency worldwide.

Industry insiders note that UPCX faces the challenge of adhering to stringent regulations by Japan’s financial services institutions to drive the payment revolution in the Japanese market. These fundamental regulatory requirements include:

- Financial Instruments and Exchange Act: This primary law governs securities and market trading regulation.

- Payment Services Act: This legislation covers legal requirements for payment services, especially those pertaining to cryptocurrencies.

- Anti-Money Laundering Laws: These regulations mandate financial institutions to implement robust customer due diligence and continuous transaction monitoring to prevent money laundering activities.

To comply with these requirements and operate successfully in Japan, UPCX needs to take the following steps:

- Obtain Necessary Licenses: UPCX may need to acquire a payment service provider license and/or cryptocurrency exchange license, depending on its business model.

- Ensure Client Fund Safety: Comply with legal requirements for fund segregation and protection to guarantee the security of client funds.

- Implement KYC and AML Procedures: Establish robust “Know Your Customer” (KYC) and Anti-Money Laundering (AML) processes to identify and verify user identities, as well as monitor and report suspicious transactions.

- Protect Data Security: Strictly adhere to Japan’s Personal Information Protection Act and other relevant data protection and privacy regulations.

- Conduct Compliance Reporting: Regularly report to financial regulatory authorities on business operations to ensure transparency and maintain auditable records.

By implementing these measures, UPCX aims to establish trust and credibility in the Japanese market, which will be foundational for its push to innovate in payment and financial technology. Successful compliance will position UPCX as a leader in Japan’s payment revolution and lay a solid foundation for its expansion into other countries.