UPCX is leading a transformation in the global payment industry through blockchain technology. The payment company recently unveiled its unique blockchain payment solution, which can achieve real-time cross-border transactions, a feat unimaginable within the conventional financial system.

In modern society, digital payments and financial services act like the lifeblood, flowing through every corner of daily life. However, much like a blockage in the bloodstream, the way these services are provided and their efficiency also face many challenges.

Imagine a scenario where transaction processing is often delayed. In this case, the cross-border transactions for completing a transaction can take up to several days! Furthermore, the cost of transactions can be prohibitive, with consumers and merchants required to pay additional fees for each transaction. More seriously, there are approximately 1.7 billion “unbanked” individuals globally who are overlooked by traditional financial services, unable to enjoy the convenience and efficiency these services bring. Additionally, how to face cybersecurity threats is an important issue that must be considered and resolved.

Against this backdrop, we will delve deep into UPCX, an emerging digital payment and financial services platform. This article will detail how UPCX employs its unique blockchain technology to provide unique and innovative solutions for existing challenges, opening up endless possibilities in the payment and financial sectors.

Cross-Border Payments:

Today, cross-border banking transaction volume has reached an incredible 10 to 15 billion deals annually, totaling between 25 and 30 trillion dollars. Consequently, the international cross-border payment clearing system, represented by SWIFT, has exceptionally high operating costs. Furthermore, the average price for traditional correspondent banks to complete a cross-border payment is tens of dollars. Such high costs are unacceptable for a large number of small transactions.

Regarding efficiency, the traditional cross-border payment model has a complex process involving multiple institutions. The complexity of this process means remittances usually need 2-3 business days, which could be better for businesses and individuals who need to complete transactions quickly.

Moreover, the centralized architecture of the current cross-border payment clearing system poses significant security risks. In recent years, centralized international cross-border payment systems have been attacked by hackers multiple times, resulting in increasing losses. Banks in several countries have been attacked by hackers attempting to steal money, specifically targeting cross-border transfer systems. This security risk is a severe threat to the global cross-border payment system.

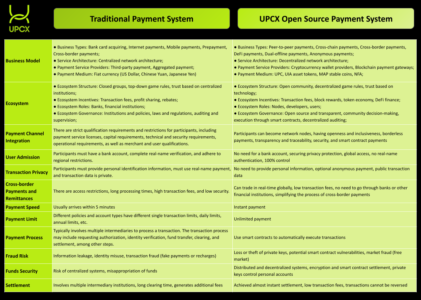

To address these problems, the UPCX system uses Graphene as the underlying technology to provide a more efficient, secure, and convenient cross-border payment solution through innovative design and advanced technology.

UPCX has implemented a hybrid consensus mechanism to improve efficiency and ensure safety, combining DPoS and BFT. This mechanism not only significantly enhances the system’s processing capabilities but also provides the security of each transaction. UPCX has adopted sharding technology to increase system throughput further, dividing the entire network into multiple independent transaction processing segments, also known as “shards” or “slices.” This approach greatly enhances the network’s processing capacity because each shard can process transactions in parallel, allowing UPCX to successfully achieve performance levels that compete with, and even have the potential to surpass, traditional payment systems.

For instance, Visa, the world’s largest credit card company, can process 4,000-6,000 transactions per second under normal circumstances, and during peak times, the processing capacity can reach 65,000 transactions per second (TPS). This is undoubtedly a very high standard in the payment system, as it needs to ensure the security and accuracy of each transaction while handling large volumes. The technological strategy adopted by UPCX makes it possible to reach, or even exceed, such processing capabilities.

Moreover, UPCX’s practical performance and scalability can compete with credit cards and mobile payments through the hybrid consensus mechanism. It can achieve nearly instant payments and settlements and extremely low fees, significantly different from the traditional cross-border payment system, which requires several days to process a transaction and incurs high costs.

UPCX’s decentralized structure and hybrid consensus mechanism provide strong security guarantees. In traditional payment systems, all transactions must be processed through a centralized institution, making it a prime target for attackers. In UPCX, no centralized institution exists to attack, making it difficult for external attacks to impact the system significantly. At the same time, even if there are malicious nodes, consensus can be reached, and transactions can be confirmed through the BFT mechanism, ensuring the network operates normally.

Consumer Payments:

Globally, there are billions of people who are still in an unbanked state, having limited contact with the modern financial system. They don’t have access to the services of the contemporary financial system. Therefore, they can’t purchase goods online, can’t get loans to improve their lives, and can’t save for unprecedented situations.

UPCX is an innovative payment solution that uses blockchain technology to solve the payment problems of the global unbanked population. Establishing a decentralized payment network, allowing anyone, no matter where they are, to have access to financial services, is one of UPCX’s goals.

As previously mentioned, one of the significant advantages of UPCX is that it can realize instant cross-border payments, meaning you can transfer money to another place within a few minutes, no matter where you are in the world, without going through a bank or other financial institution. This way, unbanked people can participate in the global economy more conveniently.

The decentralized feature means that UPCX is not controlled by any single institution. Thus, even in places where the government is unstable, or the financial system is imperfect, people can trade and save securely.

In addition, UPCX has introduced some innovative features to replace the traditional banking system fully! These features include convenient payment and QR code payment functions like WeChat and Alipay, which simplifies the operation of using digital currencies for daily payments, making them easier to accept and use. Users can make payments at any merchant that supports UPCX, whether online or offline (UPCX supports dual offline payments), by scanning the merchant’s UPCX QR code.

Through its innovative payment solution, UPCX not only helps the global unbanked population to get involved in the modern financial system and enjoy more financial services and opportunities, but also provides a convenient and secure payment method for everyone, whether it’s for cross-border payments on a global scale or for consumer payments in local stores.

More about UPCX:

UPCX is a groundbreaking open-source payment system driven by high-speed blockchain technologies optimized for seamless settlements and financial services. In today’s vibrant digital age, UPCX is at the forefront of blockchain’s mission to shape the future of finance.

Official website: https://upcx.io/

Medium: https://medium.com/@UPCX-Platforms

Twitter: https://x.com/Upcxofficial

Twitter(upcxcmo): https://twitter.com/Yutaka_UPCXCMO

Telegram: https://t.me/UPCXofficial

Telegram Channel: https://t.me/UPCXchannel

Discord: https://discord.gg/YmtgK7NURF

Instagram: https://www.instagram.com/upcxofficial/

Facebook: https://www.facebook.com/upcxofficial